Running a blog can quickly turn into a small business and that means learning some small business basic skills - like how to invoice clients and manage payments.

If you’re making money from your blog – congratulations! This is a huge accomplishment, and also a sign that you’re on your way to building your own small business.

One crucial business skill that you need to have is the ability to write, and keep track of, invoices. Creating an invoice isn’t difficult. There are free templates available in Microsoft Word and Microsoft Excel. There are also websites that you can use to create and track invoices like PayPal, Freshbooks or Aynax, and even free apps like Wave.

Personally, I like to create my invoices in Microsoft Word. I just create a master invoice template and then fill it in every time I need to invoice a client. You can download my Invoice Template for Bloggers in Microsoft Word!

Managing invoices can be a bit trickier, but it’s very important to do. You don’t want to be in a situation where you’ve invoiced a client and then discover three months down the line that they never paid you. You absolutely have to keep track of your invoices, and I’ll give you some tips on that later in this article.

Why Do You Need an Invoice?

I know some companies that are happy to just work with an email agreement. In these cases they will send an e-transfer to you once you submit your blog post link to them. There is nothing legally wrong with this arrangement, but it’s not a good way to do business.

Invoices help convey information and expectations between you and your client, much in the same way that contracts do. They should be clear, detailed, and help you maintain a paper trail for your work.

Find out how your client is going to pay you before you sign your contract. You are working with a contract aren’t you? Of course you are.

Anyhow, it’s important to establish your billing terms in advance to avoid any nasty surprises for you or your client. Your contract should list the amount you’re going to be paid, and what work you’re going to do. Your invoice should be a direct reflection of that contract.

Common Components of an Invoice:

Your Contact Information:

You must include at least your full name and address on your invoice. This is especially true if your client is planning on paying you by cheque. It’s also a good idea to list a phone number and email address so that they can easily get in touch with you if needed. You can also include your blog’s logo on the invoice, if you so desire.

Your Client’s Contact Information:

You must include the name of the individual or company that you are working for. If you’re working for a large company, they may require you to address the invoice to a specific person in accounting, or a specific department. Get this information before you create your invoice. It’s also a good practice to include your client’s address, if you have it.

Invoice Number:

The invoice number is what you will use to track your payment. Ideally when your client pays you, they should reference your invoice number so you know which payment goes with which invoice. You will also need this number if you have to follow up on an unpaid invoice (more on that later).

How you number your invoices is up to you. Most people seem to go with a basic numeric system like 0001, 0002, but you can do whatever works for you.

Invoice Date:

You should write the date on your invoice so both you and your client know when it was sent. Obviously.

Terms:

If your client agreed to pay you as soon you as bill them, you should list the terms as “payment due upon receipt”. If they said they would pay you within 30 days, you would write “Net 30” or “payment due within 30 days”.

Due Date:

This is optional if you’ve included the terms on your invoice, but it’s handy to include the date the payment is due.

Description:

This is where you describe what you’re asking to be paid for. For example, your description could say something like “blog post about apples with two photos”.

Unit Price:

In blogging, the unit price usually refers to your rate per hour. For example, your unit price might be $20/hr. If you worked for 2 hours the amount would be 2, multiplied by your unit price of $20, for a balance due of $40.

Amount/Balance Due:

This is the total amount that your client owes you. If you are working with clients in the United States, you should outline if you want to be paid in Canadian dollars (CDN) or U.S. dollars (USD).

Taxes:

You may be required to collect taxes depending on the size of your self-employed income. Check with an accountant or the CRA's website to determine whether or not this applies to you. Most bloggers are providing a service so are only required to charge GST or HST (but this varies from province to province). In most cases, you will charge your client the tax rate of the province they are located in, which may be different than the province you work out of. Again, check with an accounting professional.

Make Cheques Payable To:

If you are accepting payments by cheque, it’s crucial that you tell your client who to write the check to. I know several bloggers who have been unable to cash cheques because their client wrote it to their blog title, not their name. If you have a business account for your blog, you might be using your blog name for your cheques.

PDF Your Invoice

Always send your client a PDF version of your invoice. A word document can be edited and altered by anyone but a PDF will be read only for your client and is more professional.

Invoices in PayPal

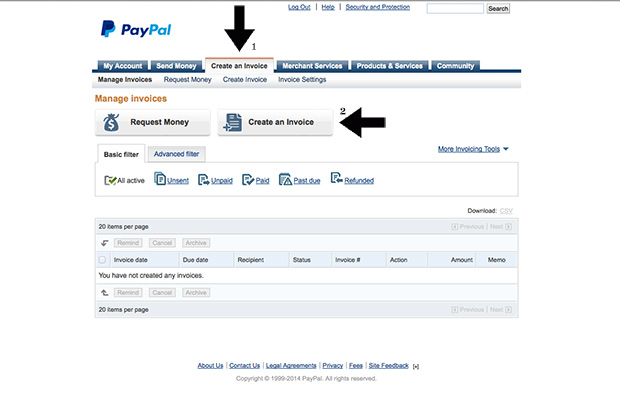

As I mentioned earlier, you can easily create and monitor invoices through your PayPal account.

To Create an Invoice:

- Click on the “Create an Invoice” tab at the top of the screen.

- You will see 2 options: “Request Money” and “Create Invoice”. Click on “Create Invoice”.

- Fill out the form with your information, your client’s information, etc.

- Save the invoice, then send.

- Print a copy for your records, if desired.

Managing Invoices in PayPal

- Click on the “Create an Invoice” tab at the top of the screen.

- If you have created invoices using PayPal in the past, they will show up in a list on this screen.

- You can send reminders or cancel invoices from this page.

Note: It’s important to remember that PayPal may charge a fee when you receive a payment. If your client wants to pay you through PayPal, you might want to ask them to pay a certain amount to compensate for PayPal’s fee. You can learn more about PayPal fees here.

How to Track your Invoices

In order to properly manage your invoices, you need to keep a record of the following information:

- What was the invoice number?

- Who was the invoice sent to?

- When did you send the invoice?

- When was the payment due?

- Have they paid you, and if so, how much did they pay?

You can keep track of this information in a notebook, Word document, or use an Excel template.

Every time you send an invoice to a client, record it. Then be sure to review your invoice log frequently so you know exactly when to expect payments.

What Should You Do if a Client Misses a Deadline?

First of all, don’t assume that the person doesn’t want to pay you. Invoices get misplaced, emails get overlooked - things happen! The last thing you want to do is a send an angry (or threatening) email to someone who owes you money.

Yes, you might be living paycheque to paycheque, and yes, the fact that they haven’t paid you might be grinding your gears. But trust me - a missed payment is not worth ruining your relationship with that client.

If no payment has been sent and the deadline has passed, you absolutely should take action. First, take a look at the invoice you sent and make sure you didn’t make any mistakes. Is the due date correct? Did you send it to the right person? Once you’re sure everything is copacetic, go ahead and get in touch with your client.

Send a polite and professional reminder, and be sure to include the invoice number so they know what to look for. I found this example over at LessAccounting.com, and I think it’s almost perfect:

“Dear ----,

I hope this note finds you well. I want to follow up on an invoice I emailed on April 1. I haven't received the payment yet, so I wanted to ensure the email isn't lost somewhere in depths of cyberspace. Would you please check to see if the accounts payable department has received it? I'll be happy to resend if necessary. Otherwise, I look forward to receiving payment within a week.

I really appreciate your help! Thanks!”

That note is friendly, but it clearly communicates that you’re expecting the payment. The only thing I would add is the invoice number in there somewhere.

If you don’t hear back from you client after sending an email, then a follow up phone call would be appropriate. Again, you want to maintain a professional tone, and never threaten your client.

I know that’s a lot of information, but hopefully you found this article useful. Good luck with your invoicing!

Disclosure: I am not affiliated with any of the websites that I mentioned in this article.

Shareba Abdul is a food blogger and freelance writer. She holds an Honours Bachelor of Applied Arts in Media Studies, a Diploma in Journalism, and has a passion for writing, photography, and blogging. You can check out her yummy discoveries at InSearchOfYummyness.com or connect with her on Facebook, Pinterest, Twitter and G+.

I use word as well to make my invoices and the document name is the invoice number (which is ‘year_invoice#” so like 2014_015). I like your suggestion of creating a spreadsheet to record all the invoices. I don’t have that, but I’m definitely going to start one now! It’s like the record at the back of your cheque book! Smart 🙂

Thanks Janice! I only just started using the spreadsheet myself, but it’s so handy once you get started. I like your naming convention, that makes a lot of sense 🙂

Not always something you think about, but it’s helpful to have an easy how-to guide to this. It can get overwhelming and complicated, but you guys have done a great job laying the ground work!

I really needed to read this right now – I have to do a better job tracking invoices and chasing payments! Thanks for the tips!

Perfect timing ..

Thanks ladies! I’m glad that this is useful to you 🙂

Informative and practical advice … just what’s needed!

This is exactly what I needed! Thank you!!

This is great – thank you so much!

Very informative post especially for new bloggers like me who have just started doing sponsored post! Thanks for sharing

Hi Shareba,

Your step by step guide on creating an invoice is SPOT ON! One more way of creating an invoice is through online invoicing software.

My company has developed one specifically for bloggers, freelancers and small businesses. Please do give it a try! Here’s the url –> http://www.quickinvoiceonline.com

Thanks!