As we gear up to do our taxes this year, we're all struggling with blog expenses - so we've recruited an expert: Angele from Shoebox Be Gone kicks of a three part series between now and March to help you get organized and tax ready - it's bookkeeping for bloggers! Take it away Angele!

You’ve heard the horror stories: bloggers having to pay higher taxes, fines, and levies because accountants and CRA auditors refuse to count your food blogging expenses. They’re not dense – mostly – but they lack a general misunderstanding of the business of blogging, never mind food blogging.

I know the veterans in the crowd have pulled many a hair getting ready for taxes – and the rookies are sweating with anxiety at the prospect of having to do so.

Fear not my friend, that’s why I’m here.

Keeping track of blogging income and expenses doesn’t have to be complicated, and it doesn’t have to be stressful. The basics of what counts as a business expense is the same for everyone and with my help you’ll soon have your eggs lined up and tallied.

This 3-post series will be a life-changer. You’ll learn to look at your pantry as a filing cabinet of sorts, and reorganize it accordingly. We’ll talk about planning posts, recipes and expenses in a way that makes sense from an auditor’s point of view and we’ll track said expenses and related income.

Your Kitchen - A Filing Cabinet for Food Bloggers

The first step in your transformation is to view your cupboards as a filing cabinet and food as the paperwork that fills it.

It’s generally not recommended to mix personal and business papers, so why should food be any different?

Aren’t you tired of constantly trying to figure out the cost of 2 cups of flour, ¼ tsp of salt and 3 tbsp of ketchup? Of trying to remember if that jar was bought at full price or on sale? Or how about which percentage of a recipe was business, and which was personal?

Let’s fix this, shall we?

Exhibit A – My Humble Kitchen

I don’t love my kitchen – in fact, I hate it – but lack of space is not a death sentence for simplified and organized expense tracking.

First you’ll purge – anything expired, suspicious, or that you know you’ll never, ever, eat – throw it out.

This simple exercise will take 10-15 minutes at most and will create space you didn’t know you had.

Next, you’ll go shopping. See, I told you this was going to be painless! Head to your local supermarket and buy the staples of every decent kitchen: Flour, sugar, cornstarch, baking powder, spices, shortening, butter, milk & eggs if you use them often in your recipes, and other non-perishables you use often. If you buy anything else, make sure to pay for it separately.

Having a completely separate receipt for your blog expenses is Golden Rule #1 in audit-proofing your food blog.

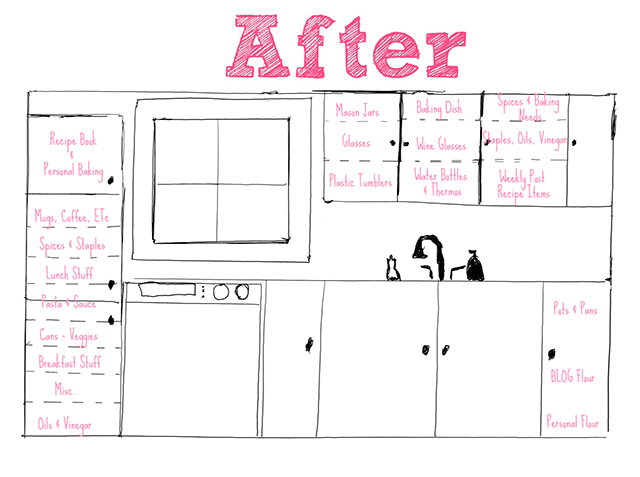

Last but not least, putting it all away. What you need here is a completely separate cupboard and fridge shelf for your blog.

Since you’ve created extra space, you can now move things around.

Select one area of your kitchen, and one shelf of your fridge, for your blog food. When whipping up a batch of cookies use only food from your blog cupboard. Part 2 of this series will focus on planning your posts and related expenses so you always have what you need on-hand.

Doubling that recipe? 1 batch from the blog cupboard, and 1 from the personal cupboard. If you’re missing something in your blog shelves buy what you need – and nothing else – and keep your receipt. You’ll learn what to do with those in Part 3.

Method to the madness

It may seem silly right now to have 2 jars of every spice, condiment, and baking supply. Try not to mock my ways too much, as all will be revealed in Part 2 – The Reinvented Planner.

Meanwhile, make space for your food blog filing cabinet. An old freezy box or dollar store plastic bin can be used to corral veggies, condiments, and meat in your fridge and freezer. A separate cupboard or shelf space in your pantry will house your business supplies – the foods used to cook up some blog magic.

The systems you put in place today will help you succeed throughout the year, and will also help protect your business expenses for years to come.

Haven’t monetized your food blog yet? Putting these systems in place now will help you focus on your goals. Bonus? When that first opportunity comes along you’ll be ready to ride the wave.

Are you ready to focus on your creative genius? To shine, thrive, & succeed? Grab the tax bull by the balls and show it whose boss. Don’t let fear of taxes cripple your efforts – learn the rules, play fairly, and come back next month for Part 2.

The Rest of the Audit Proof Your Food Blog Series

Angele Lafond @shoeboxbegone is an award-winning accountant and the leading expert in blogging & taxes. She prides herself on speaking human and in her spare time (Ha!) blogs the funnies at DomestiqueManager.com. Her kids are her life, and she loves cooking up amazing dishes with cheeky names. She’ll try to convince you she’s Angelina Jolie’s secret twin – the jury’s still out. Angele wears many hats in a day: Chief Creator of Genius, Wife, Mother, Writer, Photographer, Public Speaker. Possibly addicted to coffee. Find her on Twitter and Facebook.

SaveSave

Great tips. I never realized you could be audit for writing a blog. Guess because I don’t make money on mine.

Hey Becca! Anyone can get audited regardless of what they do, but blogging – and food / craft / dyi blogging even worse – is still largely misunderstood by the taxation community. To be clear though, if you receive product or gift cards as compensation you *are* making money 😉

This is such an excellent post. I have not monetized yet but I do have a separate pantry for all my cooking/baking products I currently use for baked goods I make as testers. I actually love having that stuff separate. It makes it easy to grab and go and will be perfect for expenses down the line. Love the simple graphic of your set up too!

Thank MJ! And yes, this is great for testers too!

Also, even when not monetized its great way to track how much a hobby or book development is costing you 🙂

Oh yeah, tax season is creeping up on us again – arg! Great post you have here, thanks for the advice – even though I’m not a food blogger I’ll Pin for my other blogger friends!

Hey Heather thanks! I appreciate that :). I’m also not a food blogger but I do this when I’m posting a recipe or a craft project! 🙂

I haven’t truly monetized my blog yet but it is nice to know that this is an option for bloggers, especialy bloggers. I think if I ever start a food blog, the last thing on my mind will be taxes and come to think of it, I’d be nice to be prepared. Thanks for the tips.

Hi Melissa!

Your comment suggests to me that you’ve made some money – even if small – on your blog. Check out http://shoeboxbegone.Com/helpmyblog to fund out exactly what counts as income from the cra / IRS perspective, and how you can minimize the taxes owing on that income 🙂

This is great! I love blogging! Great tips!

Blogging is fantastic, isn’t it? I’m glad you enjoyed the tips 🙂

These are great tips!! I hate dealing with taxes and have learned separate is best my accountant finds it so much easier to figure out what the real business expenses and for my budget for the blog as well. Excited to see the next part of your series!

Thanks Tammi! Looks like you’re already on the right track 🙂 Part 2 is another game changer – not only will your accountant love you today, you’ll make it super easy to deal with an audit if ever you have to. 🙂

These are great tips. Although I don’t have a food blog, I know that I need to keep up with my income/expenses for my blog. I just found out this year that you could be audited. I had no idea!

Amy anyone can get audited, bloggers included 🙂 Having everything tracked properly does not prevent one, but does make it easier for your to prove your income and expenses, thus protecting your tax credits. Check out http://shoeboxbegone.com/helpmyblog for blogging specific tax resources 😉

I never imagined it took this much for food bloggers. WOW…..that is one organized kitchen now.

We haven’t monetized our blog, but it is something that we’ve discussed and perhaps we will in the future. I would have never thought of all this, but what incredibly helpful information. I’m going to share this with my hubby, although we have a different niche, this is applicable in terms of understanding the necessity of record keeping and looking at expenses. Curious to see your part 2!

You know what, I’ve never thought of this. I just started blogging myself late last year so this will be my first year at it and getting things organized. I’m not a food blogger but I do post recipes here and there. This is going to be a challenging year!

I so loved this post that I had to share it. I’ve been really good this year about keeping my receipts for food blog posts. I look forward to reading the other posts.

It’s tax time! But I honestly do not know how to compute the taxes. My blog earnings probably is just $15/month so I don’t know if I still have to pay tax. Thanks for this post though coz at least it gives me clarification of the expenses especially that I have a craft blog too.

This is SUCH a great post!! I have recently started monetizing my blog, and have saved a few receipts, but I haven’t made enough to make filing worth it. Hopefully next year I’ll have a reason to save those receipts! Looking forward to the next parts of this series.

Great tips here! I’m glad I started preparing for this from the start. Blog started in 2009 and monetized it in 2012. One year later, bam — I was audited! Luckly, I’d been keeping all my in separate cupboards as you suggested. This includes all linens that I’ve written off, all utensils used in photos, plus serving dishes, etc. Another thing that I have started doing since I was audited is to carry a pen with me so I can itemize my receipt on-the-spot, right there in the store as soon as I’ve paid for the groceries. The auditor suggested this and it’s really helped. I now write the recipe name or recipe “concept” at the top of the receipt. This really helps a lot because at my age I can’t always rely on memory to help me identify receipts when it comes time to do so. (I also separate ingredients before getting to the till so that the ingredients for testing purposes go on separate receipts.) Great and timely advice here, thanks! I look forward to the rest of your series 🙂

Wow, this was an interesting read. I had no clue that you could be audited for things related to your blog expenses. I haven’t even thought about blog expenses before. You really gave me a few things to think about. And, ugg…my kitchen lacks space too. Drives me crazy whenever I get a new kitchen gadget or appliance.

[…] Click HERE to read the full article! […]

I haven’t monetized my blog yet, but am heading in that direction so this is helpful information to have. I confess, I had a strong initial reaction to the idea of two sets of ingredients. To me, that introduces more waste as some ingredients last only so long, and having double of them makes it more likely they’ll need to be tossed before used up. But, I realize I need to think of my blog as a separate business with a separate location. I’ll be moving house in the near future, so that presents a good opportunity to get everything set up to accommodate this approach. Gotta keep CRA happy!

Great advice, I really, really need to do this. With gluten-free baking, and 8 or 9 kinds of flours – I may need a separate kitchen! 😉 Or maybe some custom shelving would be the answer…

I just found your blog and I’m so thankful because I actually made money last year and am in a bit of a panic about filing my income tax return. I found your free resources for bloggers but have one question re: internet expenses. If I’m only a part-time blogger, can I write off 100% of my internet costs or do I have to figure out the percentage of time I spend actually writing a blog post & promoting it to determine how much of the cost I can write off??? Help!

[…] month in part 1 of Audit-Proff Your Food Blog, we discussed cupboards and logistics, transforming your kitchen into a filing cabinet for food […]

[…] organized your kitchen, planned your posts and expenses, and now it’s GO time. Some of you are living vicariously […]

Hi Angele,

These are all great tips – thank you so much! Question: How do you deal with things like perishables that aren’t used often? For example, if I buy yogurt for a recipe post and only use half of it, but don’t have any other posts coming up that include yogurt, do I just lose the rest of the yogurt? I try to be really intentional about not wasting food and am just trying to find a way around this.

Also, I live in a rural place and many things I cook with aren’t available locally, or if they are they’re very expensive. When I go to Halifax a few times a year I go to Costco and stock up on bulk items like nuts, etc. If I can’t get there any time soon would you recommend that I pay the premium for those items to buy them locally (even though I have some in my personal pantry)?

Sorry for the specific questions! I completely understand the importance of this issue and would like to do this properly. My husband and I just started our blog five weeks ago and I’ve been keeping receipts but not had an entirely separate store of food. I would like to get on the right track.

I really hope you’re able to respond even though this is an older post!

Thank you!